I have equity in my home but bad credit

A HELOC is an authorization for you to withdraw money from that credit line as you need it. Lenders prefer that you have a minimum of 15 or 20 percent equity in your home.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

If you divide 100000 by 200000 you get 050 which means you have a 50 loan-to-value ratio and 50 equity.

. A traditional home equity loan and a home equity line of credit HELOC. This can be done through your existing lender or a new lender and is not considered a second mortgage. I need 100 dollars loan now.

Thus a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. You may be able to borrow up to 80 of the equity in your home through a home equity loan or line of credit but to do that you must first have a good amount. According to Bankrate you typically need at least 20 equity.

In fact they very rarely if ever lend more than 80 of a homes equity value. Lenders that allow a combined loan-to-value ratio of 80 may. There are general guidelines for getting approved these include.

Loans against the equity in your home come in one of two forms. You find out by multiplying your home value by 75 and then subtracting your mortgage balance. The amount of the loan is likely to.

A traditional home equity loan. Ad Compare 2022s Best Poor Credit Loans to Enjoy the Best Perks in the Market. Your debt-to-income ratio or DTI is one of the most important factors lenders look at when considering a loan.

Applying for any loan requires an in-depth application process. Ad Update Your Home Or Pay Down Debt - Make It Happen With A Cash-Out Refinance From Chase. A score of 36 or.

Unfortunately opening a home equity line of credit or refinance loan still depends on a lot of factors including. 1 Home equity is defined as the difference between what you owe on your. 2022s Best Home Equity Loans.

The more equity you have the better will be your loan interest rates. For the example above then you multiply 400000 75 to get 300000. At least 15 percent to 20 percent equity in your home keep reading below to see how market values can.

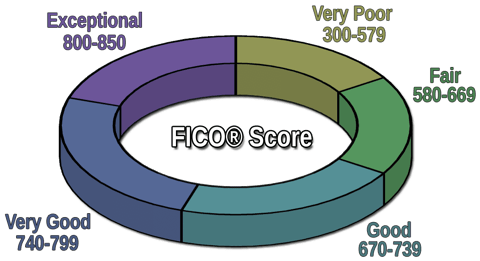

Use LendingTrees Marketplace To Find The Best Option For You. Cut Debt by 50 or More. Consider alternatives to bad credit home equity loans if you have bad credit which generally means a score less than 580 you probably wont.

Use Your Home Equity Get a Loan With Low Interest Rates. Ad Give us a call to find out more. Get The Cash You Need To Pay For Whats Important.

Having bad credit can seriously hamper your ability to borrow money including home equity loans. For example if your home is appraised at 250000 and you still owe 175000 your LTV is 70. Ad Give us a call to find out more.

If you decide to take out equity with bad credit you can face terms that are less favorable than you would if your credit were more pristine. The first step in home equity loan eligibility is straightforward. Calculate your debt-to-income ratio.

1 Low Monthly Payment. Get Started in 5 Mins. Apply in 5 Minutes Get the Cash You Need in Just 5 Days.

Ad Your homes equity is a great resource to help knock some items off your to-do list. Ad Credit Cards Maxed Out. While the home equity loan will likely offer a fixed interest rate the HELOC often.

Ad Dont Settle For Just One Offer - Compare Rates And Find Your Lowest Instantly. You need to have at least 20 equity. If a lender lets you borrow up to 85 of the value of your home you could.

For instance if you have a home valued at 500000 and two home equity loans totaling 425000 youve already borrowed 85 percent of your homes value the cap for many. Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. With 50000 in equity that would mean a max loan amount of 40000.

Resolve Credit Card Debt. You could also try. Ad Top 5 Best Home Equity Lenders.

However those with lower credit scores can still qualify for. HVCUs HELOC offers the flexibility of accessing money when you need it most. The process for applying for a home equity loan with bad credit is similar to getting any other type of mortgage but there are a few extra steps youll need to follow.

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

How To Get A Mortgage With Bad Credit Bad Credit Mortgage Bad Credit Loans For Bad Credit

Park Bank Home Equity Ads On Behance Home Equity Equity Line Of Credit

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Top Mortgage Myths Demystifying Common Home Loan Misconceptions Home Loans Mortgage Small Business Loans

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Pin On New Home Tips Rental

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Let A Home Equity Line Of Credit From Noble Credit Union Get You Over The Hump With Rates This Low Saving Money Is A Line Of Credit Credit Union Home Equity

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

There Can Be Many Reasons Behind Need Of Mortage Like First Time Home Buyer Mortgage Renewal Refin Mortgage Tips Mortgage Marketing Pay Off Mortgage Early

Welcome To Trademyloan Com Use Our Website To Find A Home Loan Home Equity Loan Commercial Loan Or Private Loa Home Equity Commercial Loans Home Equity Loan

Fixed Rate Home Equity Line Of Credit Appraisals For Low Income Families Home Equity Best Home Loans Home Improvement Loans

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Companies Owned By The 16 Largest Private Equity Firms Have Weaker Credit Than Spec Grade Companies Not Owned By Bad Credit Mortgage Improve Credit Bad Credit

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Home Equity Loans Mortgages For Bad Credit Self Employed Bad Credit Mortgage Mortgage Loans Mortgage Rates